Federated Funding Partners Things To Know Before You Get This

Table of ContentsThe 5-Second Trick For Federated Funding PartnersFederated Funding Partners - QuestionsThe Single Strategy To Use For Federated Funding PartnersThe Federated Funding Partners StatementsThe Ultimate Guide To Federated Funding Partners

Debt debt consolidation loans will typically permit greater levels of borrowing than charge card equilibrium transfer choices as well as lower interest rates than many credit scores cards. You will wish to be particular that the car loan's regular monthly payments are less than your existing overall minimum month-to-month charge card settlements, along with a lower rate of interest.

Drawbacks of a debt consolidation financing Financial debt loan consolidation financings might not have minimum credit rating needs however will base their rates of interest and settlement terms on your credit report rating. When your financial obligation combination car loan turns your credit rating cards back to a zero equilibrium, you might be attracted to make use of that credit score, which can advance your bank card problem.

Build & keep healthy credit history behaviors You've ultimately decreased your bank card financial debt by taking one of the choices over. Here's exactly how you can maintain it that method: Automate your settlements and pay your full equilibrium each month The largest consider your credit history is your history of settlements: keep them in a timely manner as well as you'll see your credit rating slowly develop.

Federated Funding Partners - Truths

With the greater credit report that feature financial obligation settlement, you'll begin to gain approval for incentives cards that provide either cash money back, traveling discount rates, or presents. Real indication of fantastic credit scores is when you invest less than what you make.

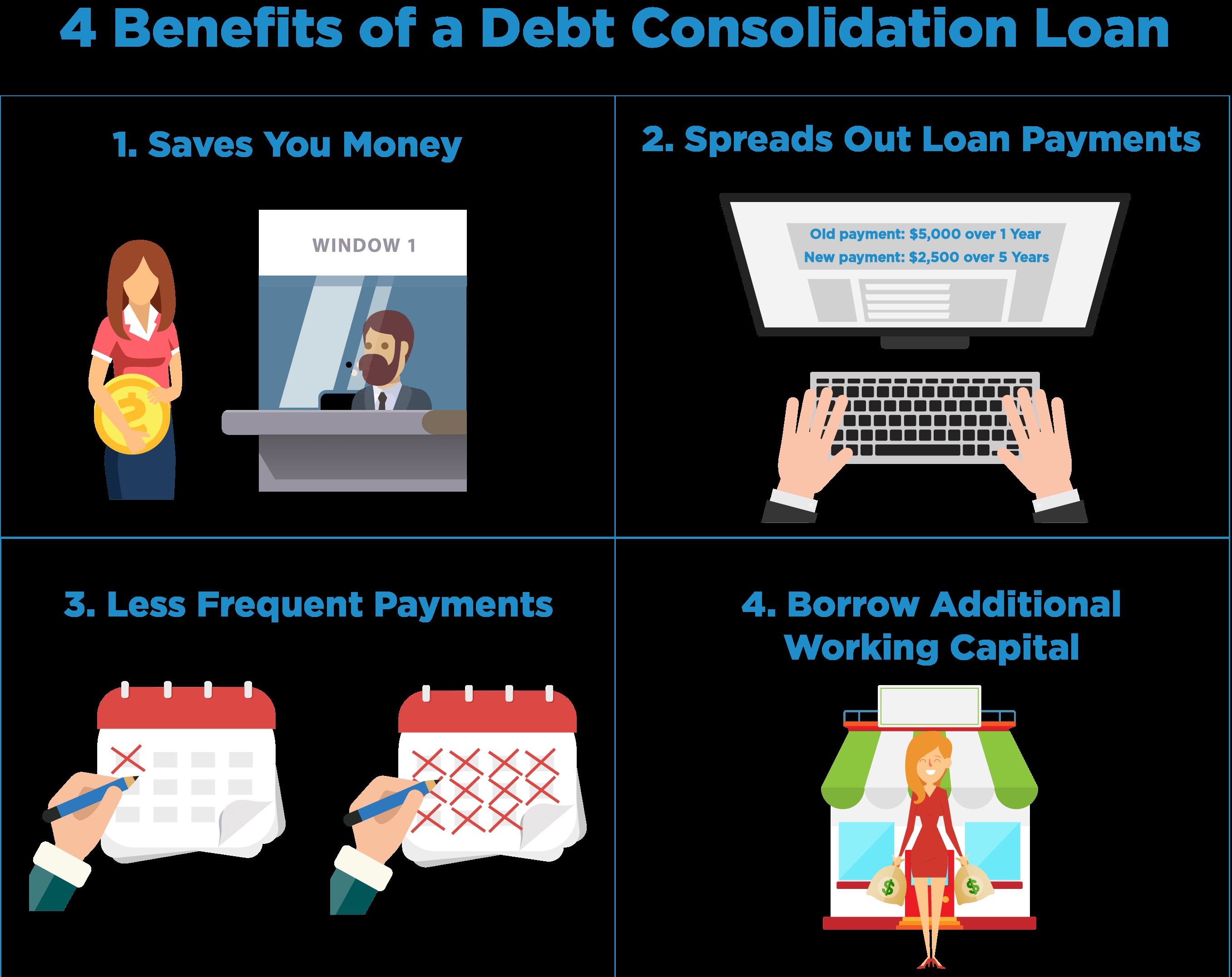

Before continuing with a financial debt consolidation lending, it is crucial that you comprehend all aspects of it. Below is a list of both the benefits and disadvantages of financial debt loan consolidation financings.

Furthermore, with numerous payments debtors commonly rack up a considerable quantity of passion when they are unable to settle each individual debt whereas with a debt combination pop over to this web-site car loan there is simply one simple repayment, so rate of interest will likely be lowered each month.: debt consolidation funding rate of interest rates tend to be reduced than charge card rates, so you conserve money and also settle your financial obligations quicker.

Some Known Details About Federated Funding Partners

As a matter of fact, since you have minimized your interest settlements, it is possible that your credit scores ranking will actually enhance as an outcome of your new financial obligation consolidation financing (federated funding partners). Drawbacks of a Financial Debt Loan consolidation Finance To receive a financial obligation loan consolidation lending, you may be required to offer some form of collateral.

If you owe more than you can manage, a financial debt combination lending is an option absolutely worth thinking about., so we suggest you assess all of your choices and after go to this website that decide which choice is appropriate for you.

Struggling to handle your financial debt settlements? Combining your financial debt can be an excellent means to streamline your financial resources and also bring your month-to-month spending controlled. However there are numerous kinds of financial obligation combination and each approach features particular dangers. federated funding partners. So before making a decision, here are all the things you need to think about.

All about Federated Funding Partners

The advantage of financial obligation consolidation is usually some mix of the following: Fewer monthly settlements to take care of Lower total rate of interest charges Smaller sized overall monthly payment Reduced total expense to pay back all debts In various other words, debt consolidation need to make your life less complicated and also save you cash. Naturally, that's not a guarantee.

Below are what could be thought about the 6 most common approaches: Unsafe consolidation funding You can secure an unsafe loan from your economic institution of choice and also make use of the funds to settle your arrearages. You'll after that be paying back the car loan each month as opposed to your old financial debts - federated funding partners. Home equity financing If you have equity in your house, you can obtain a finance against that equity and make use of the funds to repay your financial debts.

Debt administration strategy Functioning with a nonprofit credit report counseling agency, you can enroll in a financial debt administration strategy. Below you'll make one repayment each month to the company, which will certainly make creditor settlements on your part. This is not a funding, yet many creditors will certainly offer decreased rates of interest and other rewards for settling via a debt administration plan.

Find i loved this out more regarding credit scores as well as financial debt loan consolidation: Following steps Any kind of lingering inquiries regarding debt consolidation? Examine out the post linked listed below for more details. Starving for more responses? Link with among MMI's trained credit counselors. If you have questions concerning financial obligation, debt, and also individual expenses, they have the assistance and also sources you need.

The 8-Minute Rule for Federated Funding Partners

Should you try a debt consolidation car loan? Financial debt loan consolidation car loans integrate all unprotected financial debt right into one funding and one regular monthly repayment.